Why 2026 Is the Year We Stop Pretending

Two forces are converging on the global economy.

In 2023, tech companies demonstrated what artificial intelligence could do. In 2024, they restructured around what it meant. In 2025, they laid off over 180,000 workers.1 Meanwhile, global average temperatures breached 1.5°C above pre-industrial levels for the first time across an entire year.2 Insurers withdrew from Florida and California. Unprecedented flooding struck Valencia. Drought depleted hydroelectric capacity across three continents.

As we enter 2026, it is worth asking what happens when the cost of thinking approaches zero while the cost of surviving rises.

The economy we inherited was built on a particular set of assumptions. Human labour had value because cognition was scarce. Natural resources were cheap because the atmosphere could absorb waste freely. Risk could be priced because the past predicted the future.

Each of these assumptions is failing simultaneously.

According to the International Monetary Fund, roughly 40% of jobs worldwide are exposed to AI disruption. In advanced economies, that figure rises to 60%.3 Goldman Sachs economists estimate that generative AI could automate the equivalent of 300 million full-time jobs globally.4 The cognitive scarcity that underpinned wages is evaporating.

At the same time, the physical world is reasserting constraints that three centuries of industrialisation taught us to ignore. Fresh water, stable coastlines, predictable growing seasons, insurable property, breathable air during wildfire season: these are becoming the scarce commodities of the twenty-first century. In the old economy, profit came from arbitraging information and labour. In the emerging economy, value concentrates around resources and the capacity to manage risk.

Private markets are failing at both.

Consider what is already happening in insurance, that most fundamental market for pricing risk.

In 2023, State Farm and Allstate stopped writing new homeowner policies in California.5 In 2024, multiple insurers exited Florida entirely. Exposed homeowners turned to state-backed insurers of last resort, which now cover millions of properties that private markets have deemed uninsurable. This is not a temporary adjustment. It is the private sector admitting it cannot price climate risk at rates customers can afford to pay.

The pattern will spread. Supply chains disrupted by extreme weather cannot be insured against disruptions. Agricultural yields subject to unprecedented volatility cannot be hedged reliably. Coastal infrastructure that may not exist in thirty years cannot secure long-term financing.

When risk becomes unquantifiable, markets seize. The only institution capable of absorbing unquantifiable risk is government, which can spread exposure across entire populations and across time through sovereign debt.

AI complicates this picture further.

Artificial intelligence drives the cost of intelligence toward zero. A legal brief, a medical diagnosis, a software application, a financial analysis: the marginal cost of producing these approaches the cost of electricity. For industries built on cognitive labour, margins compress toward nothing.

But AI also consumes resources on an extraordinary scale. Training a single large language model can consume as much energy as a small town uses in a year.6 Data centres are proliferating globally, their cooling systems drawing water from aquifers already stressed by drought. The technology that eliminates the value of human cognition simultaneously intensifies competition for physical resources.

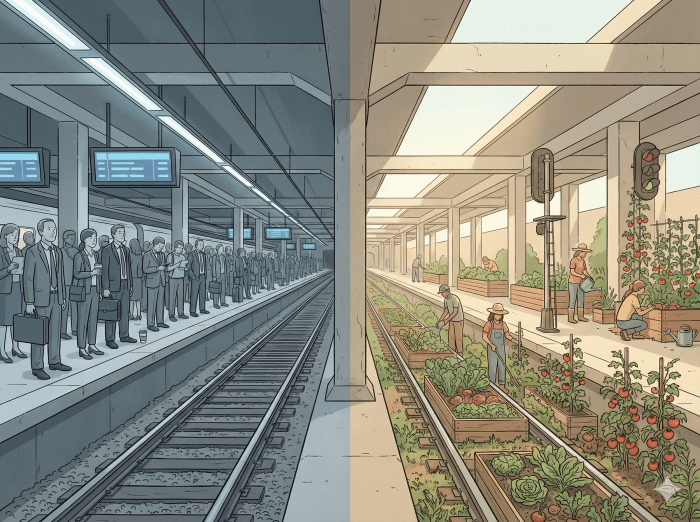

This creates a bifurcated economy. Cognitive services become abundant and nearly free. Physical resources become scarce and contested. The private sector can profit from neither end: margins vanish where abundance reigns, and risk becomes unmanageable where scarcity bites.

What remains profitable is ownership of resources and the capacity to manage systemic risk. These are not competitive advantages that markets allocate efficiently. They are functions that, historically, only states have performed at scale.

The transition from the economy we have to whatever comes next will unfold in phases. But unlike previous economic transformations, this one is compressed by converging pressures. AI and climate change are arriving together, not in sequence.

Phase One: Tinkering at the Edges

This is where we have been.

On the AI front, policymakers spoke of retraining and education reform. On climate, they set distant targets and relied on carbon markets. Both approaches assumed existing frameworks could absorb the shocks through gradual adjustment.

The assumption was optimistic. Previous technologies augmented human capability; AI substitutes for it. Previous environmental shifts were slow enough for adaptation; climate change is delivering decades of projected impact in years. The taxi driver could learn to drive for a rideshare company. But what does the rideshare driver learn when the car drives itself and the roads flood three times a year?

The tinkering phase ends when incremental responses become obviously inadequate. We are at that point now.

Phase Two: Emergency Response

We are entering this phase as 2026 begins.

The pressure comes from multiple directions simultaneously. AI displacement accelerates, contracting consumer spending. Extreme weather events intensify, requiring emergency outlays and driving inflation through disrupted supply chains and volatile food and energy prices. Insurance gaps widen, leaving governments to backstop losses. Each crisis strains public finances; each response demonstrates that government can act directly where markets cannot.

Politicians will frame these interventions as emergencies. They will promise that normal conditions will return. But “normal” is receding. The emergency measures will accumulate into something that looks less like crisis response and more like a new operating system.

Income support for displaced workers. Public employment programs for climate adaptation infrastructure. Government-backed insurance where private markets have retreated. Direct provision of essential services that private enterprise can no longer deliver profitably. Each intervention normalises the next.

Phase Three: The Contested Transition

The transition between phases will not be peaceful.

Two sets of incumbent interests face obsolescence: industries displaced by AI and industries threatened by decarbonisation. Their resistance will compound. We should expect aggressive intellectual property regimes to preserve AI rents. We should expect climate denial and delay to protect carbon-intensive assets. We should expect both to manufacture scarcity where none needs to exist.

Fossil fuel companies will lobby for the energy demands of AI to be met by gas and coal. Tech companies will resist regulations on water and energy consumption. Both will frame government coordination as overreach, even as they quietly rely on public infrastructure, public research, and public risk absorption.

These coalitions will slow the transition. They cannot stop it. The deflationary pressure of near-zero-cost intelligence is difficult to contain. Climate disruption continues regardless of political resistance. When competitors can produce cognitive services for nothing and when extreme weather makes asset values unpredictable, the old models of profit extraction fail.

Government will assume coordination not through ideology but through necessity. Someone must organise production when margins disappear. Someone must allocate resources when markets cannot price risk. Someone must plan for thirty-year infrastructure when private capital demands five-year returns.

Phase Four: Resource Coordination and Risk Mutualisation

In this phase, the challenge becomes administrative rather than ideological. How does government coordinate resource allocation and risk management at scale?

Critics will invoke familiar objections. Central planning failed in the twentieth century because planners lacked information and prices provided essential signals. The objection has merit in a world of stable scarcity, where markets can discover value through exchange.

But the twenty-first century presents different conditions. Digital systems can process information at scales that dwarf human bureaucracies. More fundamentally, the challenge is not discovering prices in stable markets but managing resources under conditions of radical uncertainty and non-linear change.

When climate makes the past a poor guide to the future, price signals derived from historical data become unreliable. When AI makes cognitive labour nearly free, wages no longer signal productive value. Markets are good at rationing scarcity and pricing risk. In a world of cognitive abundance and unquantifiable climate risk, those functions require different institutions.

Resource coordination means managing water, energy, arable land, and habitable territory as collective endowments rather than private commodities. Risk mutualisation means spreading exposure across populations and generations through instruments only sovereigns can issue. These are practical responses to conditions that markets were not designed to handle.

Phase Five: The New Settlement

The final phase is characterised by the absence of crisis as a permanent condition.

A generation will come of age for whom government coordination of resources and risk is how things work. They will study the market economy with historical interest, puzzled by the notion that private actors could profitably intermediate between people and their survival needs. They will find it strange that a stable climate was once treated as a free good and that the ability to think was once the primary source of wages.

Work will persist, but its purpose will shift. The labour that remains valuable will be inherently human and inherently local: caring for people, maintaining communities, restoring ecosystems, creating meaning. Compensation will be disconnected from market contribution, recognising that human needs exist independently of productive output.

Resources will still be managed, allocated, and conserved. Risk will still be assessed, shared, and planned for. These functions will simply no longer be entrusted to institutions that require profit extraction to survive.

So where does this leave us?

AI is driving the cost of cognition toward zero. Climate change is driving the cost of physical stability upward. The former eliminates the basis for wages in cognitive labour. The latter eliminates the basis for profit from risk-bearing. Together, they dissolve the foundations of the market economy we inherited.

This is not a prediction of collapse. It is an observation about where value is migrating. In the emerging economy, what matters is access to resources and the capacity to manage systemic risk. These are inherently collective goods. They cannot be efficiently privatised. They require coordination at scales only governments can achieve.

For Those Who Govern

Leaders who wish to serve their constituents must begin thinking in these terms now.

The frameworks of the twentieth century have become actively misleading. Balanced budgets assume stable tax bases. Market solutions assume functioning price signals. Carbon markets assume risk that can be quantified and traded. Private investment assumes returns that climate volatility may not permit.

The relevant questions for the next decade are different. How do we manage resource allocation as scarcity intensifies? How do we absorb risks that markets cannot price? How do we maintain social cohesion when traditional employment no longer provides identity or income? How do we coordinate at the speed that converging crises demand?

These are not questions that markets will answer. They are questions that require political leadership willing to articulate a new settlement.

For Those Who Live Through It

For individuals, the strategic advice of the old economy may no longer apply. Upskilling for cognitive work means competing with systems that improve faster than any human can learn. Accumulating financial assets means holding claims on a future that climate may not deliver.

The preparation that matters is different. Building community resilience. Cultivating practical skills that cannot be automated and serve local needs. Investing in relationships and mutual support. Learning to live well with less material throughput.

The communities strengthened now will likely prove more durable than the portfolios accumulated. The relationships built will matter more than the credentials collected.

The demonstrations of 2023 became the restructurings of 2024 and the layoffs of 2025. The record temperatures of last year are now the baseline. These trends are not waiting for policy consensus.

What 2026 brings depends partly on choices made now. The transition is coming regardless. The question is whether we prepare for it or react to it.

Footnotes

- TrueUp Layoffs Tracker. As of December 2025, tech layoffs totaled approximately 183,000 workers across 626 companies. https://www.trueup.io/layoffs ↩

- World Meteorological Organization confirmed 2024 as the first calendar year to exceed 1.5°C above pre-industrial average. https://wmo.int/news/media-centre/2024-set-be-hottest-year-record-about-15degc-above-pre-industrial-era ↩

- International Monetary Fund, “Gen-AI: Artificial Intelligence and the Future of Work,” January 2024. https://www.imf.org/en/blogs/articles/2024/01/14/ai-will-transform-the-global-economy-lets-make-sure-it-benefits-humanity ↩

- Goldman Sachs, “The Potentially Large Effects of Artificial Intelligence on Economic Growth,” March 2023. https://www.goldmansachs.com/insights/articles/generative-ai-could-raise-global-gdp-by-7-percent ↩

- California Department of Insurance data on insurer withdrawals, 2023-2024. Multiple major insurers including State Farm, Allstate, and Farmers announced restrictions on new policies in California due to wildfire risk. ↩

- Estimates vary, but training GPT-4 class models requires energy consumption measured in tens of gigawatt-hours. Patterson et al., “Carbon Emissions and Large Neural Network Training,” 2021. ↩

You must be logged in to post a comment.